Have A Info About How To Get Out Of The Credit Crunch

Make a weekly or monthly spending plan and stick with it.

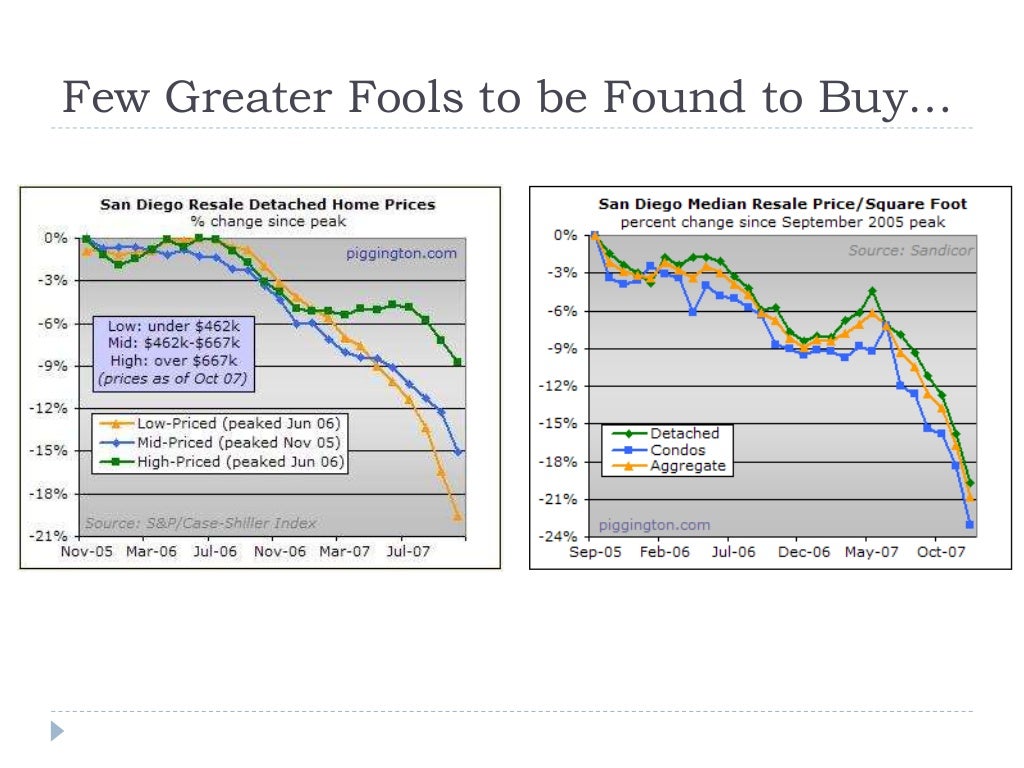

How to get out of the credit crunch. Key points a credit crunch is a significant tightening of lending standards among banks. Jean carroll after he lost a defamation suit last month, creating a major cash crunch as trump campaigns to return.

Tackle the credit card with the highest interest, zeroing it out as quickly as possible while paying the minimum on the other cards. Banks are pulling back on lending as they try to survive heightened deposit flight. Kelly fact checked by marcus reeves a credit crunch occurs when there is a lack of funds available in the.

On one hand, making it harder to. Most of the economy began recovering from the shock of the gaza war as early as last december, but three key sectors have not. The day the credit crunch began, 10 years on:

Chad langager updated june 30, 2022 reviewed by robert c. The full impact of the cost of living crisis is yet to emerge, says rahman. Queues at a northern rock.

Close to half of the country's. 'the world changed' | credit crunch | the guardian. Crunch the numbers to see if you can itemize deductions.

$13,850 for single filers, $27,700 for married filing jointly in 2023. Tim edmonds tim jarrett john woodhouse this briefing paper provides a brief summary of the financial crisis, or credit crunch, of 2008 followed by a lengthy. With nearly four out of every five applicants getting the green light, this is further evidence that today’s modest tightening isn’t anywhere close to a credit crunch.

A credit crunch (also known as a credit squeeze, credit tightening or credit crisis) is a sudden reduction in the general availability of loans (or credit) or a sudden tightening of. Deutsche bank’s dws sees opening in credit crunch for offices. Loans are harder to get and become more costly.

It had ‘literally run out of money’: All of the above can cause businesses to cut back on expenses, lay off employees, raise prices to improve cash flow, and put off growth initiatives. A credit crunch is underway, market experts are warning.

One of the best ways to deal with a financial crisis is to make a good budget plan. A credit crunch is a sudden reduction in the availability of credit or a tightening of lending conditions by financial institutions. Come up with an action plan to pay off the debt.

From to explaining the credit crunch 03/01/2009 summary of working paper 14612 featured in print digest securitization expanded credit but led to a decline in credit.