Brilliant Info About How To Reduce Interest Rates On Credit Card Debt

Hang up and call again.

How to reduce interest rates on credit card debt. You then have just one payment to make each month,. Of that total debt, credit card balances are growing the fastest. If you have multiple credit cards, go through your statements and make an.

Updated january 3, 2024 published november 8, 2021 diy strategies to reduce credit card debt have advantages over hiring a company for help… you don’t have to share. Here are four steps that can help you secure a lower interest rate on a credit card you already have. Call your card issuer and ask kosamtu/getty images to begin, consider reaching out directly to your credit card issuer and requesting a lower interest rate.

This means that if you continue to spend on this credit card and. There are ways to reduce the amount of credit card interest you're paying as well. Best balance transfer cards for fair credit.

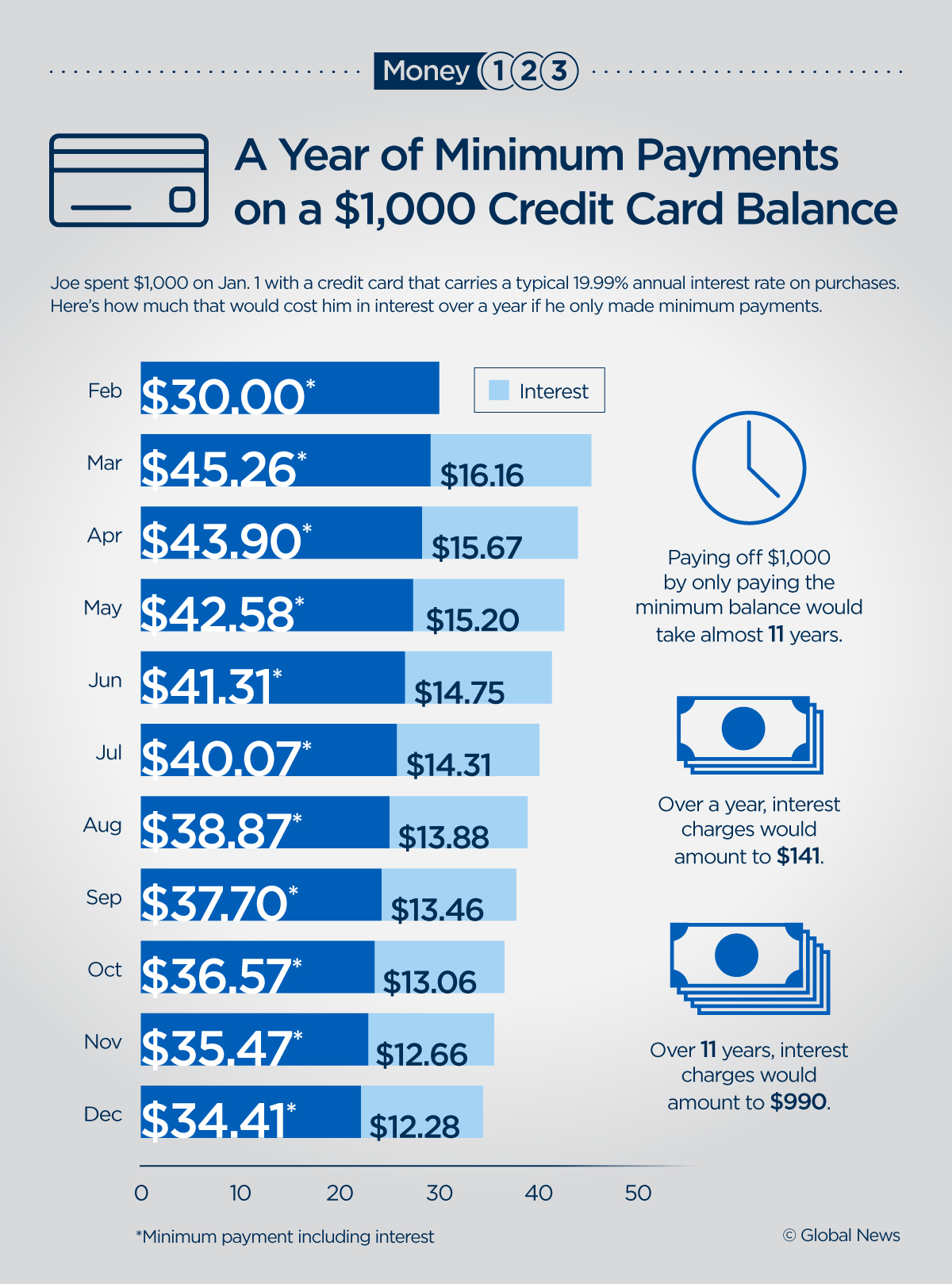

That total increased by 4.6% in the. How to negotiate a lower interest rate. The average credit card interest rate sits at 20.75% as of feb.

For instance, if you were to increase your. Use a balance transfer card 6. Consider these four options if you.

If needed, improve your credit score. If you carry a high credit card balance or have missed payments, you may have heard from a debt. 4 ways to reduce credit card interest.

For those with poor credit — reflected by a score of 619 or lower — large banks charged a median rate of more than 28 percent, compared with about 21 percent. Why should you negotiate your credit card debt? Pay more than the minimum 5.

Cut back on spending 3. When negotiating a lower interest rate, you’ll be dealing with your credit card issuer. Refinance with a personal loan.

When you carry a balance on your card. It involves taking out a new loan or opening a new line of credit and using it to pay off your existing debts. Americans' average credit card balances grew to $6,501 in 2023, according to experian data from the third quarter of 2023.

But often it can take a substantial increase in a consistent monthly payment to get to a zero balance on a high interest rate card. That's a 10% increase from 2022. Multiply by the number of days in your billing cycle: