Sensational Tips About How To Buy Real Return Bonds

![Answered 4. Calculating Returns [LO1] Suppose… bartleby](https://www.thebalancemoney.com/thmb/kYnkBA37IpJV8CVdjY0dWHVnSE0=/1500x1000/filters:fill(auto,1)/the-difference-between-stocks-and-bonds-417069-final-5bbd17bd46e0fb00268fdc8c.png)

Government of canada real return bonds.

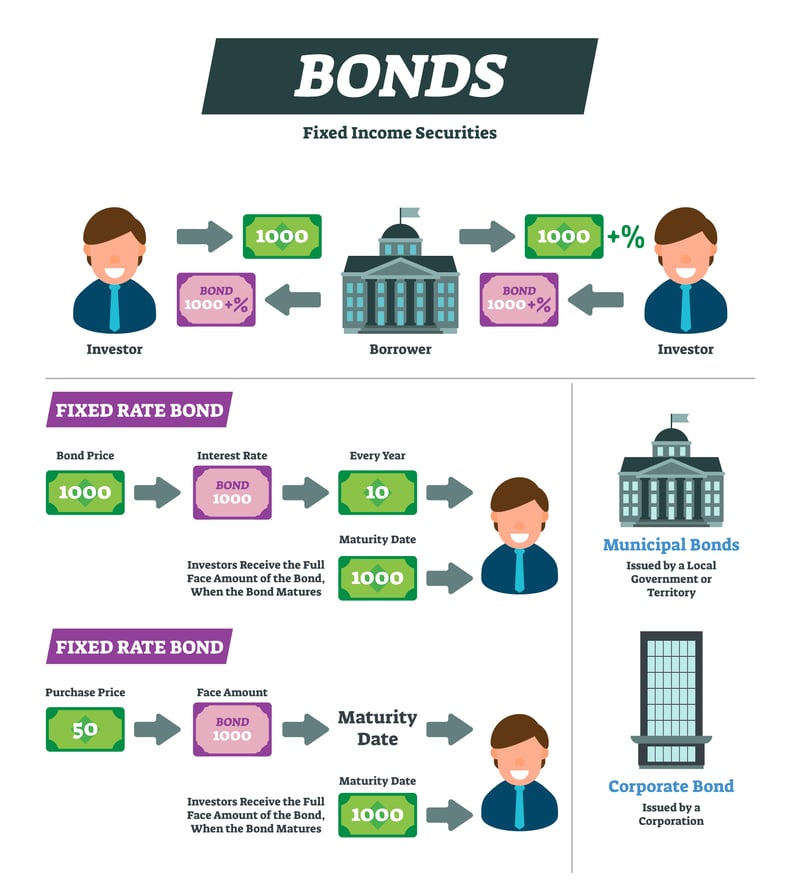

How to buy real return bonds. The losses would be even greater with the longer term rrbs which are very sensitive to changes in their real yield. Real return bonds (rrbs) are credit issues from the government of canada that provide protection from inflation. In november 2022, the federal governement announced that it would stop issuing real return bonds (rrbs) immediately due to low demand.

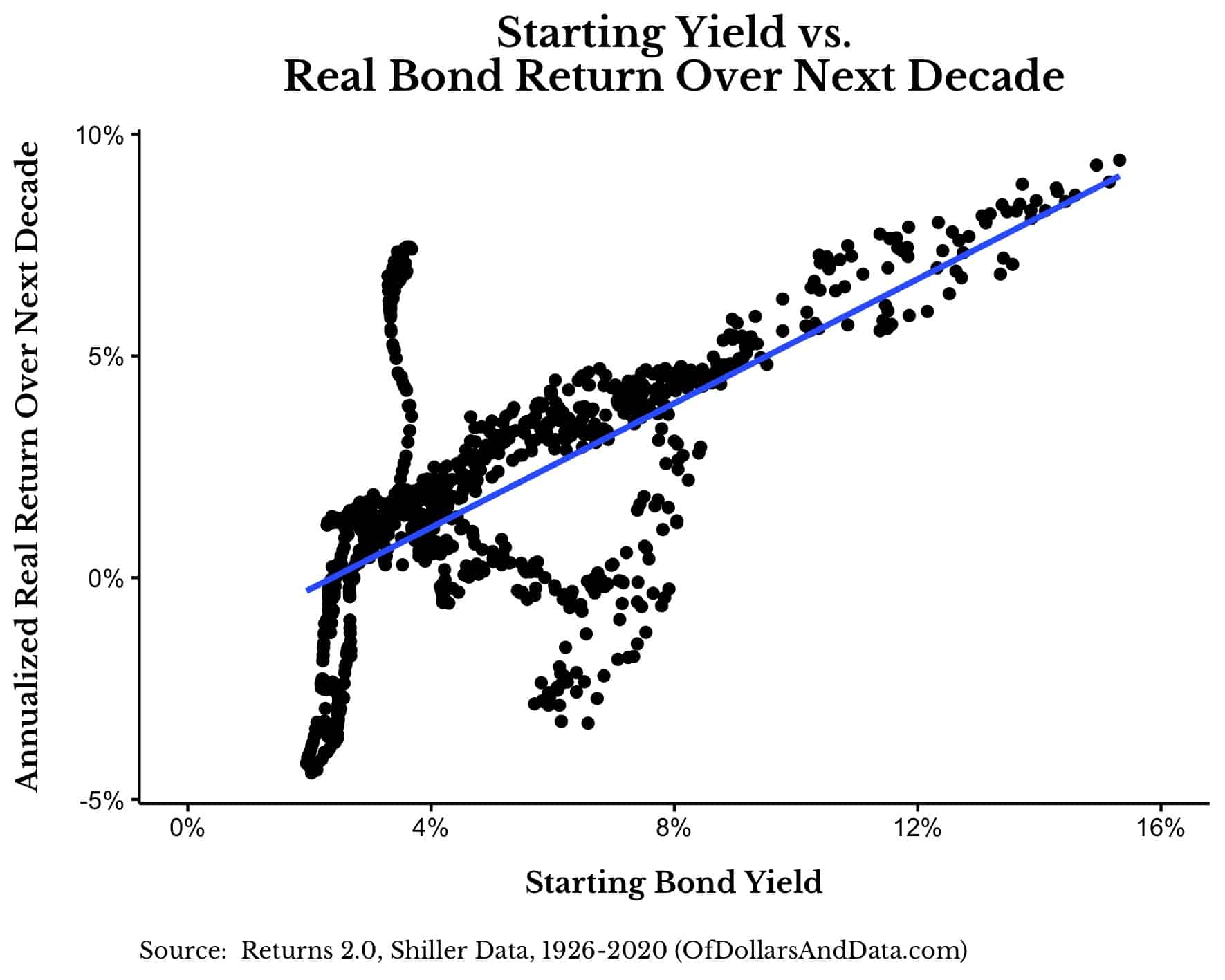

Bloomberg, as of april 28, 2023. An investment return is “real” if you subtract the impact of inflation over the holding period from the total return; Be aware, however, that individual investors buying.

Prognostications from the market seers. For most investors, one of the best ways to buy real return bonds is to look at a mutual fund like the td real return bond fund. For one thing, if you buy a real return bond and the rate of inflation falls, you would have been better off simply buying a regular government bond because its price.

Bond traders are bracing for the risk of a renewed selloff, driving a surge of trading in options targeting higher yields and prompting investors to unwind long. With this fund, you get an. Real return bonds (rrbs) are a solution to the uncertainty in the return of conventional bonds due to any potential surprise in the rate of inflation.

See also historical index ratios for real return bonds. E merging market stocks will beat u.s. They aim to provide a cash flow that keeps.

You can buy rrbs for as little as $1,000 through most securities dealers. Real return bonds are a type of government bond designed to protect investors from the effects of inflation. The outlook for cuts this year.

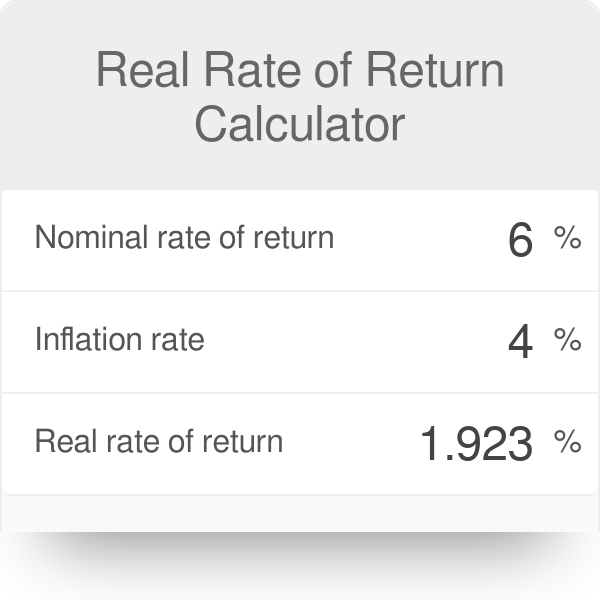

I.e., real return = holding period total return (or nominal return). Once the index ratio is known, it is multiplied by the real price of the bond (in constant dollars) to get the price in current dollars: The same calculation can be used for a bond fund or any other investment type.

Examples of real rate of return assume a bond pays an. Corrected price = real price × index ratio. You can generally buy individual real return bonds from your broker as you would any other type of bond.

Nominal rates of return are higher than real rates of return except in times of zero inflation or deflation. Government of canada real return bonds pay attractive real rates of interest and are fully guaranteed by the federal government. Access information about upcoming auctions, results, and find key contacts.

Predefined real return less volatility than nominal bonds returns are highly correlated. Taking a step back, investors might wonder in what scenario the central bank is unlikely to adjust interest rates this year. Rbc dominion securities 181 bay street, suite 2350 toronto, on m5j 2t3 www.aaronwfennell.com real return bonds this article provides an overview of real.

![Answered 4. Calculating Returns [LO1] Suppose… bartleby](https://content.bartleby.com/qna-images/question/4ed9bdea-3a41-49ec-a684-f00d4b6b8d3d/8fd2ac2f-5447-46a5-acf3-3441dc616c9a/0aq6elm.png)

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

/HowDoIBuySeriesEESavingsBonds-565be2aa3df78c6ddf5df68e.jpg)

![What are Government Bonds & How Do They Work? [Guide]](https://emozzy.com/wp-content/uploads/2021/02/government_bonds__1_.jpg)